If self-employed, a signed statement certifying the amount of the individual’s AGI and the U.S.

Transcripts irss how to#

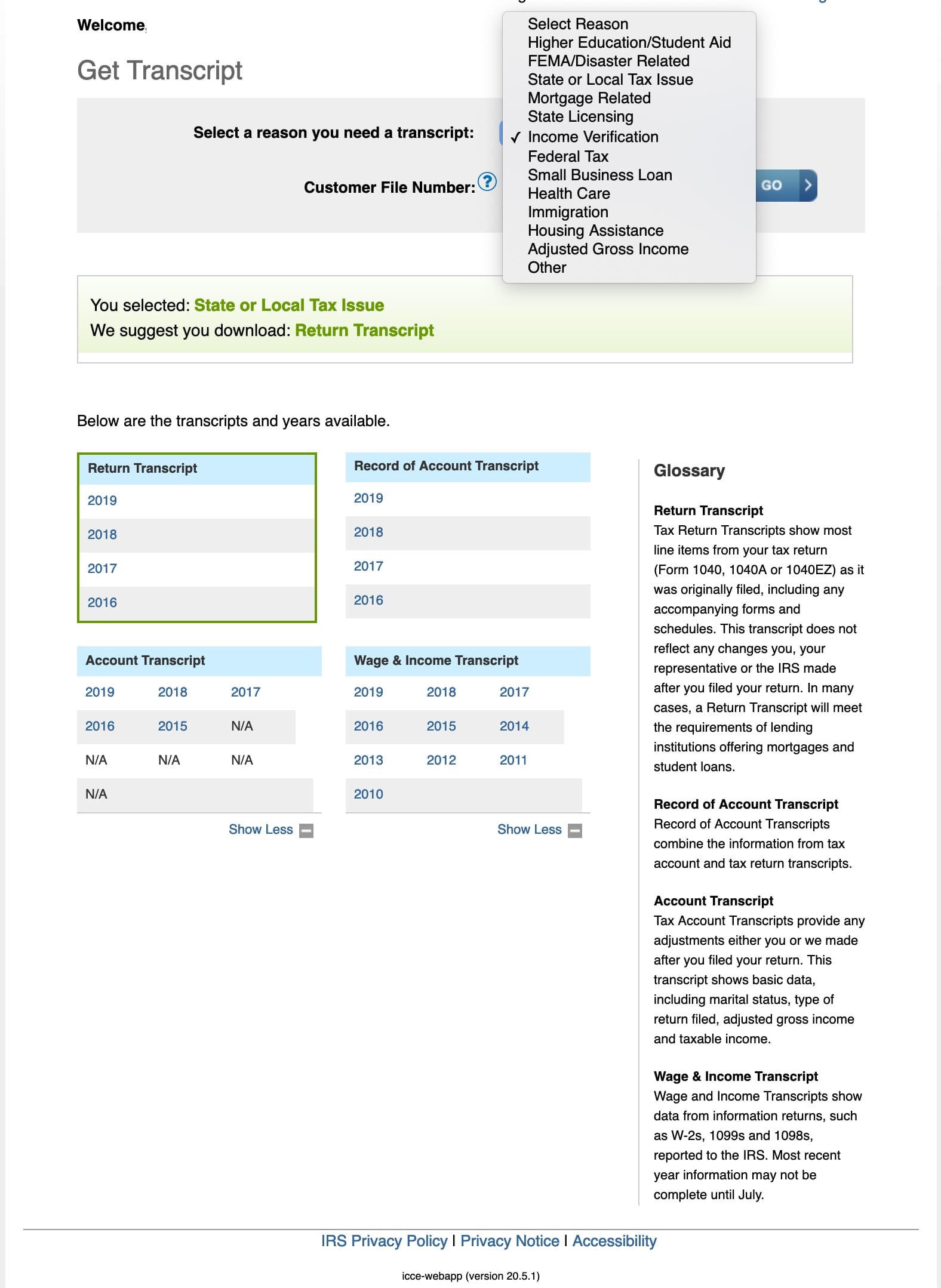

How to Request an IRS Tax Return TranscriptĪccording to the IRS website, your transcript will be mailed to you within 5-10 business days.

Need help using the IRS Data Retrieval Tool? Visit and search “IRS Data Retrieval Tool” for resources. You must submit paper copies of transcripts. If you are required to enter parent information on your FAFSA, you must do two separate transfers using the IRS DRT (one for student and one for parents).įor students/parents that amended their tax return, were granted an extension, or filed married filing separately, the IRS Data Retrieval cannot be used. DO NOT change your IRS transferred data after it has been uploaded.

If data is successfully uploaded from the FAFSA, the Financial Aid Office will no longer need the paper IRS Transcript. The Financial Aid Office recommends that before requesting a transcript that you try using the IRS Data Retrieval Tool (DRT) on your FAFSA. An IRS transcript must be requested directly from the IRS.

Transcripts irss verification#

Student’s chosen for verification may be required to submit student and/or parent(s) IRS Tax Transcripts to the Financial Aid Office.

0 kommentar(er)

0 kommentar(er)